Extended Viewer

How Prepared Are Markets for a Low-Carbon Transition?

As climate change accelerates and more climate-related regulations come into force, investors may be looking to reduce their exposure to transition risks by shifting capital away from emissions-intensive assets and toward low- or zero-carbon alternatives.1 Such a reallocation of capital may reshape global supply chains, affect the performance of individual countries and regional markets and see the emergence of new corporate winners and losers.

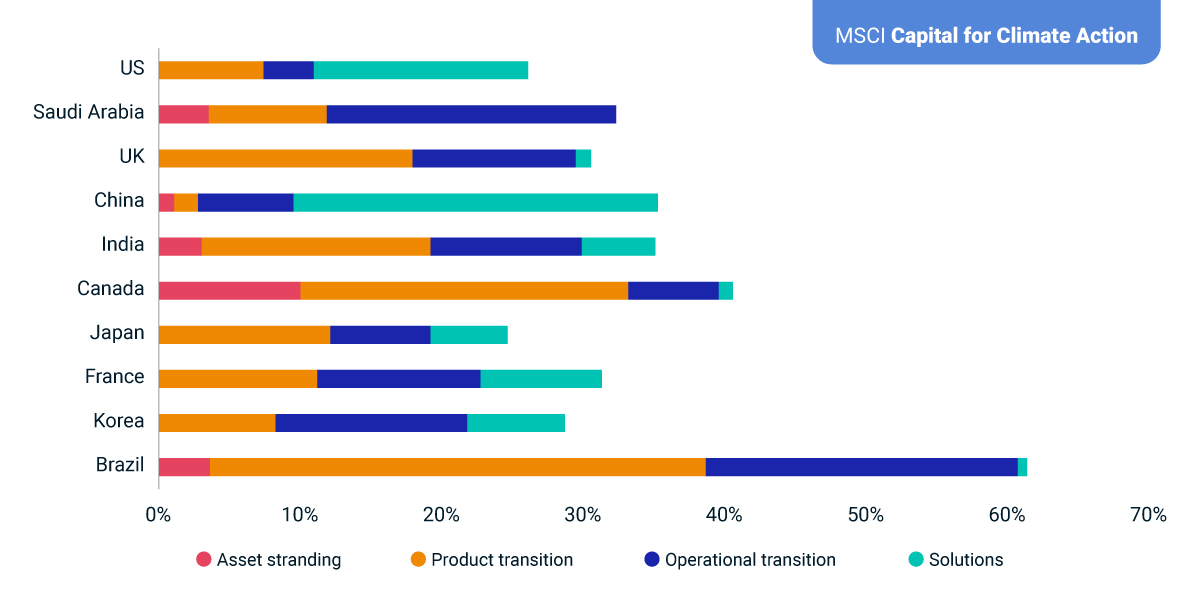

Readiness for a climate transition differs substantially across global markets, and the Asia-Pacific (APAC) region is no exception. For example, in the MSCI ACWI Index, the markets earning the most revenue from fossil-fuel production (the U.S., Saudi Arabia, U.K., China and India) were not all leaders in clean-tech production. Using MSCI Low Carbon Transition categories,2 these markets can be further characterized by the transition-risk profiles of their constituent companies, as shown in the exhibit.

Ultimately, markets or companies with riskier transition assets (e.g., those that result in asset stranding or product transition) could fall behind those with more exposure to climate solutions.

How Prepared Are Markets for a Low-Carbon Transition?

1 “Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change,” IPPC, 2022. Andrea Zanon “Green tech investment could reach $5 trillion by 2025,” Global Policy Institute, Aug. 17, 2022. Rob Bland, Anna Granskog and Tomas Nauclér, “Accelerating toward net zero: The green business building opportunity,” McKinsey & Co., June 14, 2022.

2 The MSCI Low Carbon Transition category scale has five categories: asset stranding, product transition, operational transition, neutral and solutions. Issuers in the asset-stranding category have exposure to climate-transition risks through potential stranding of physical or natural-resource assets due to regulatory, market or technology forces. Issuers in the product-transition category have exposure to climate-transition risks through potential reduced demand for carbon-intensive products and services. Issuers in the solutions category have a low total-carbon-emissions footprint and have the potential to benefit from the growth in demand for low-carbon products and services.

Related content

MSCI Capital for Climate Action APAC Conference

MSCI Capital for Climate Action APAC Conference is coming to Singapore, where investment and financial leaders from across the region will bring clarity to the low-carbon transition and the challenges and opportunities ahead.

Find out moreAsia-Pacific Leans into Developing Low-Carbon Technology

Based on MSCI Low Carbon Patent Scores, Asia-Pacific companies are leading the charge in low-carbon technology, with superior patent-quality scores in renewable-energy and energy-efficiency technologies.

Learn moreThe Climate Transition Is Increasingly About Opportunity

Climate-friendly policies and regulations and the massive reallocation of capital needed in the coming years to ensure a successful shift to a net-zero economy should continue to expand the range of opportunities for both companies and investors.

Read the report